EU-TAXONOMY

On March 8, 2018, the EU introduced an action plan for financing sustainable growth, also known as “Sustainable Finance.” This plan is grounded in the 2016 Paris Agreement and the United Nations’ 2030 Agenda for sustainable development. The focus is on redirecting capital flows to achieve a significant reduction in greenhouse gas emissions—at least 55% compared to 1990 levels by 2030—and to support the implementation of the UN’s Sustainable Development Goals (SDGs) across social, ecological, and economic dimensions.

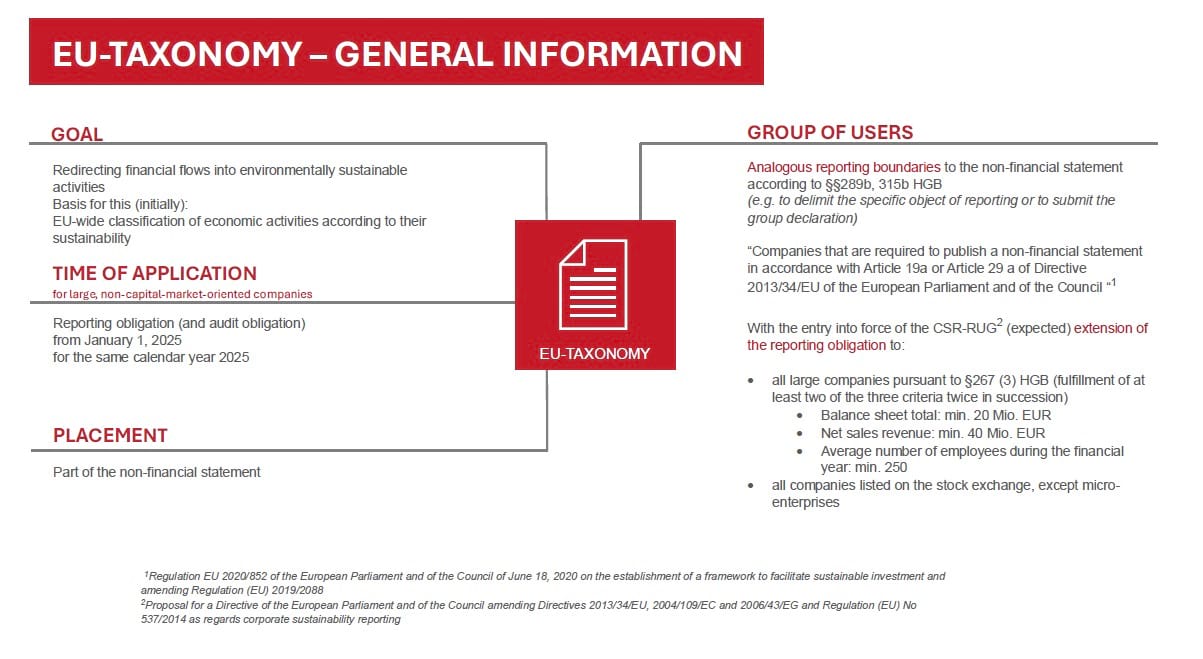

The EU-Taxonomy is a central element, introducing comprehensive reporting obligations for its target audience.

Who is affected?

Starting in 2022, publicly listed companies subject to non-financial reporting must apply the EU-Taxonomy for fiscal year 2021. Reporting thresholds align with non-financial statements under §§289b, 315 HGB.

The ongoing revision of the EU directive on non-financial reporting aims to extend reporting obligations to large, non-publicly listed companies (§267 Abs. 3 HGB). Based on the European Council's draft amendment, reporting and auditing obligations will apply from January 1, 2025, for the calendar year 2025.

Regardless of taxonomy applicability, early implementation of reporting requirements is advisable, as investors and banks increasingly consider taxonomy and sustainability information in their decisions.

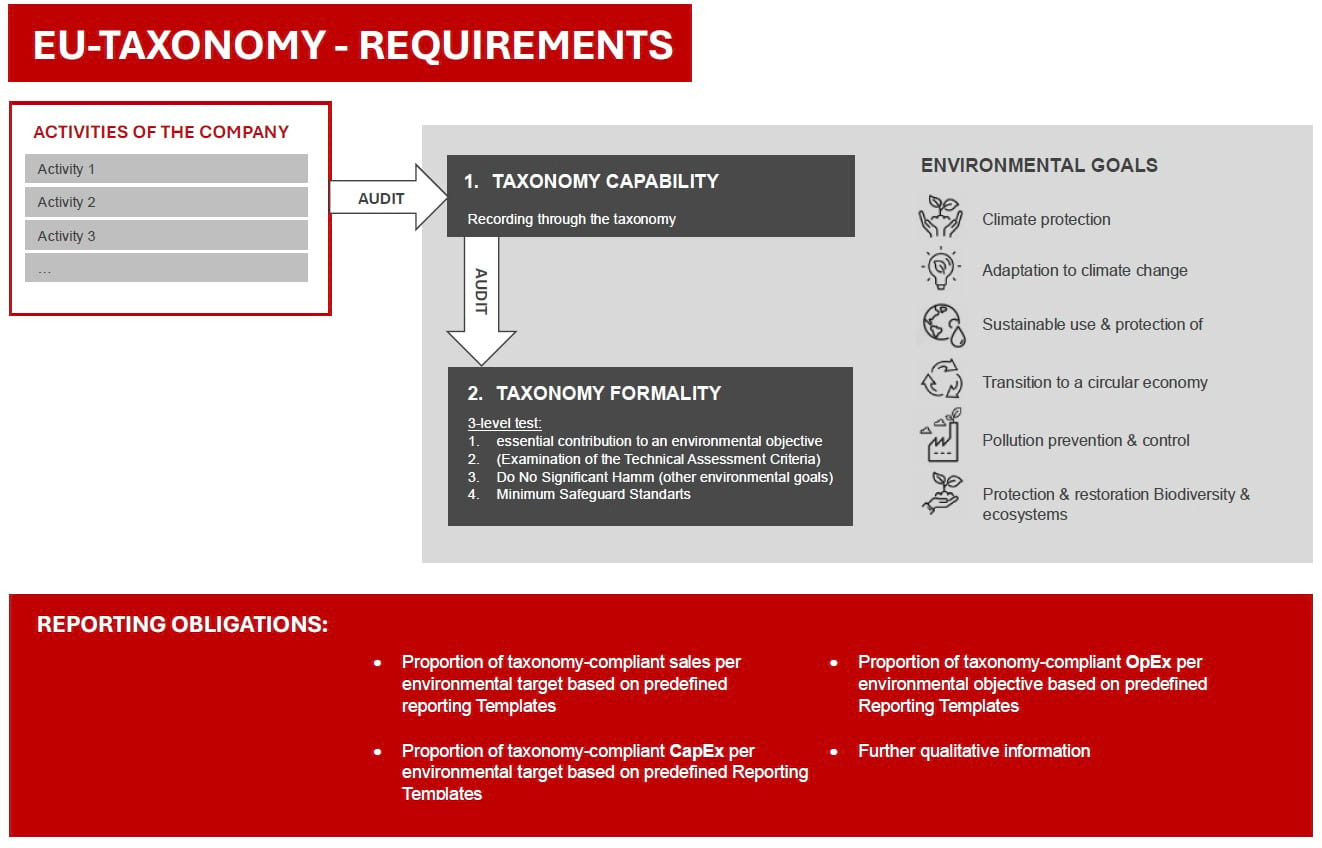

Your requirements:

Under Article 8 of the Taxonomy Regulation, companies must disclose how and to what extent their economic activities contributing to revenue, investments, and operating expenses are environmentally sustainable. Activities must first be assessed for taxonomy eligibility and then for compliance with the taxonomy’s six environmental objectives.

In addition to providing indicators for revenue, investments, and operating expenses in prescribed reporting templates, qualitative information must be included in the non-financial statement. Internal reporting processes should therefore be adjusted early to meet these extensive reporting obligations.

Our Service Portfolio:

- Support in identifying the company’s activities and assessing their taxonomy eligibility and compliance

- Assistance in determining reportable KPIs and qualitative information

- Creation of internal documentation related to implementing the EU-Taxonomy Regulation

- Support in preparing mandatory reports regarding the EU-Taxonomy (non-financial reporting)

- Assistance in adapting internal reporting processes to meet EU-Taxonomy reporting requirements

Reference:

Read the articles on reporting under Article 8 of the EU-Taxonomy Regulation by Lorson/Metz/Simon, Part 1 and Part 2.