CSRD

Corporate Sustainability Reporting Directive

Directive (EU) 2022/2464 of the European Parliament and the Council of December 14, 2022, amending Regulation (EU) No. 537/2014 and Directives 2004/109/EC, 2006/43/EC, and 2013/34/EU regarding corporate sustainability reporting.

WHAT is the CSRD?

The CSRD is the cornerstone of future sustainability reporting. This comprehensive framework represents a fundamental update to existing sustainability reporting requirements and succeeds the Non-Financial Reporting Directive (NFRD).

The CSRD pursues two primary objectives: expansion and harmonization of existing requirements. This includes not only an expansion of the scope of application and content requirements but also introduces an audit obligation. Regarding harmonization, key aspects include mandatory reporting in a dedicated section of the management report and the requirement to use the EU-standardized electronic reporting format for sustainability reporting.

Current Legal Status:

After its adoption by the European Parliament on November 10, 2022, the CSRD was approved by the European Council on November 28, 2022. Following this, the directive was published in the EU Official Journal and came into effect 20 days later. The draft bill by the German Federal Ministry of Justice for implementing the CSRD into German law was published on March 22, 2024.

The draft bill and the comparative analysis of the draft are available here:

Draft Bill and Comparative Analysis by the Federal Ministry of Justice

WHO is affected and when?

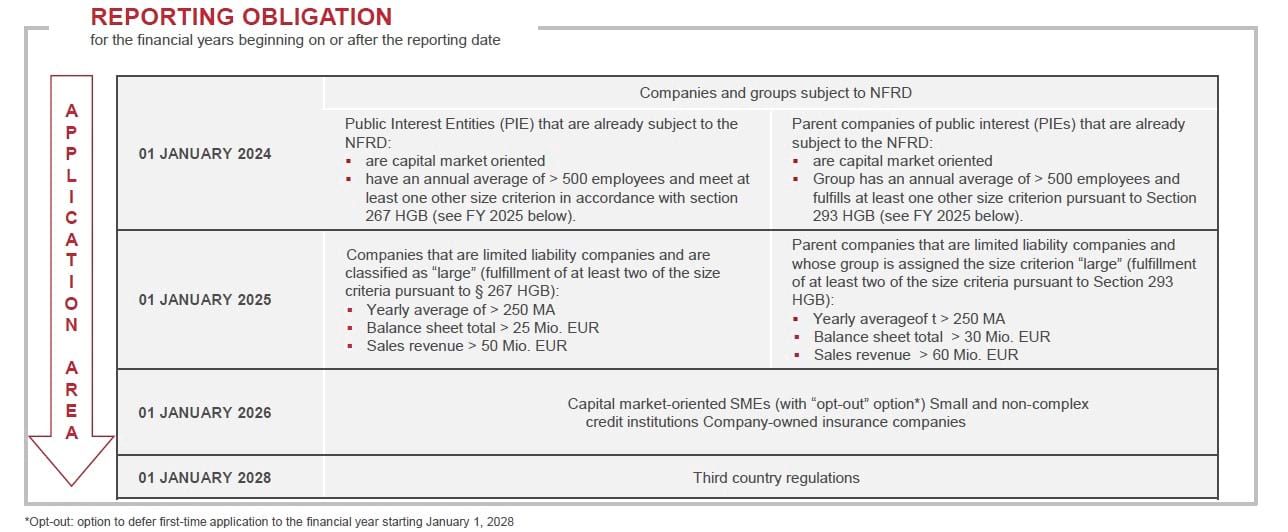

The initial application dates of the CSRD are staggered for different groups:

Companies already subject to the NFRD are required to prepare a detailed sustainability report according to the CSRD for fiscal years starting on January 1, 2024. These companies will report for the first time in 2025 in their annual financial statements about the previous fiscal year 2024 under the CSRD requirements within the management report.

Starting January 1, 2025, companies that are limited liability entities and categorized as “large” according to §§ 267, 293 of the German Commercial Code (HGB) will also fall under the reporting obligation. These size criteria include at least two of the following: > 250 employees on average during the year, > €25 million in total assets, or > €50 million in revenue.

Companies that, irrespective of size criteria under §§ 267, 293 HGB, have financial reporting requirements as if they were large corporations (e.g., specified in their articles of association) are also subject to reporting obligations under the CSRD from this point onward. This mainly affects public-sector companies.

From January 1, 2026, publicly traded SMEs, small and non-complex credit institutions, and captive insurance companies will be included in the CSRD scope, with the first reporting obligations in 2027. However, publicly traded SMEs have an opt-out option that allows them to delay their initial application to fiscal years starting January 1, 2028.

Starting January 1, 2028, third-country rules will apply.

Since the scope of the EU Taxonomy is tied to the scope of the CSRD, companies subject to the CSRD will also automatically need to report under the EU Taxonomy.

European Sustainability Reporting Standards (ESRS)

The ESRS provide the content-specific details of the CSRD. The reporting standards include particularly extensive disclosure obligations.

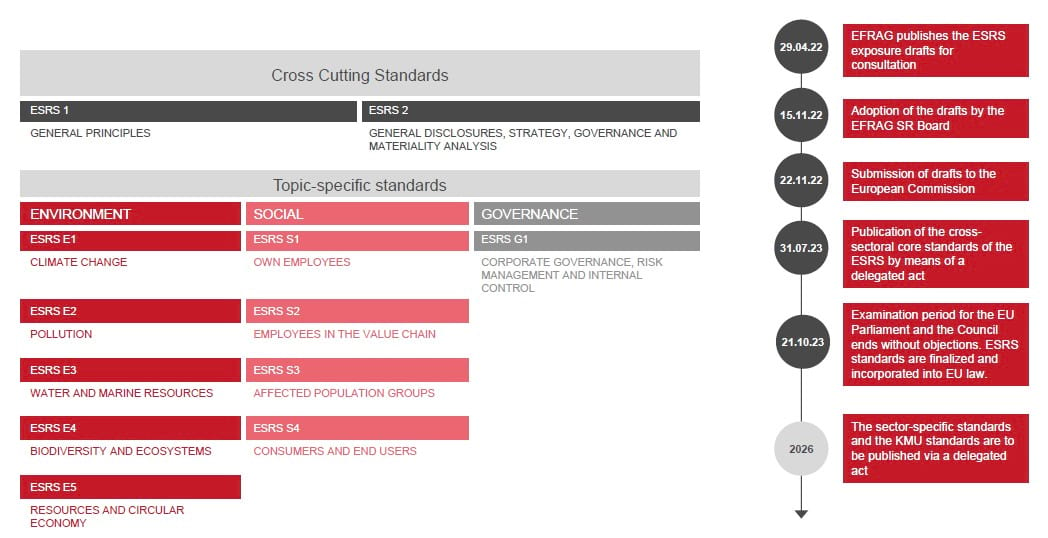

On November 22, 2022, 12 cross-sector standards were submitted by EFRAG to the European Commission. These standards were published as delegated acts on August 31, 2023.

Two cross-cutting standards cover general principles and disclosures, strategy, governance, and materiality analysis.

The ten cross-sector thematic standards are divided into three categories: Environment (ESRS E), Social (ESRS S), and Governance (ESRS G).

Additional sector-specific standards and SME standards are planned for publication in 2026.

The goal of the ESRS is to ensure understandable, relevant, representative, verifiable, and comparable information in sustainability reports by applying the double materiality principle.

Double Materiality Principle

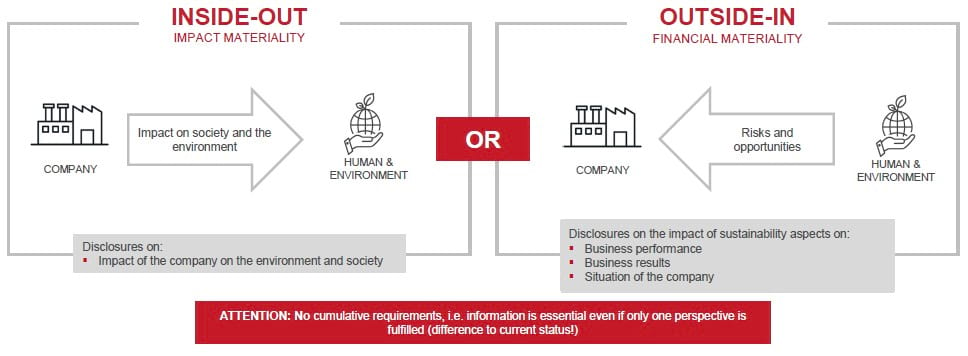

Similar to financial reporting, materiality aspects are also key in sustainability reporting. These are integrated into sustainability reporting through the concept of double materiality, which considers two independent perspectives:

The Inside-Out Perspective (Impact Materiality) captures the impacts of a company on society and the environment.

The Outside-In Perspective (Financial Materiality) assesses risks and opportunities posed by society and the environment to the business's operations, performance, and situation.

No cumulative requirements apply, meaning that information is material even if only one of the two perspectives is met.

Regardless of the materiality criterion, mandatory requirements are defined in ESRS 1.

Audit Obligations

The new EU directive also entails extensive audit obligations for non-financial sustainability reports.

In the future, companies will be required to have an external audit of their non-financial sustainability report, as part of the management report. The audit will assess the compliance of sustainability reporting with CSRD requirements, including the ESRS standards, and the process for deriving information based on these standards. Additionally, compliance with electronic reporting requirements (ESEF) and the provisions of Article 8 of the EU Taxonomy Regulation will be audited.

The audit will be conducted by the statutory auditor or a third-party auditor.

European Single Electronic Format (ESEF)

Under the CSRD, the management report must be provided in an EU-standardized reporting format in accordance with the ESEF Regulation. Certain disclosures within the report must also be tagged. The aim is to enhance accessibility, analyzability, comparability, and transparency.