EU-Taxonomy Regulation

Regulation (EU) 2020/852 of the European Parliament and of the Council of June 18, 2020, on the establishment of a framework to facilitate sustainable investment and amending Regulation (EU) 2019/2088

WHAT is the EU-Taxonomy?

The EU-Taxonomy is a central reporting element for implementing the EU’s Sustainable Finance Action Plan and involves extensive reporting obligations for its scope. It aims to classify a company's economic activities based on clear criteria to determine whether they are sustainable. The objective is to prevent greenwashing and redirect capital flows into sustainable activities.

Current Legal Status:

The EU-Taxonomy Regulation came into force on July 12, 2020, and was first applicable to its target group for fiscal years starting on January 1, 2021.

WHO is affected and WHEN?

In 2022, publicly traded companies required to provide non-financial reporting were already obligated to apply the EU-Taxonomy for the first time for the fiscal year 2021. The reporting is based on similar boundaries as the non-financial declaration under §§ 289b, 315 HGB. EU-Taxonomy reporting is included within the management report.

As the scope of the EU-Taxonomy is linked to the scope of non-financial reporting, more companies will fall under the reporting obligations of both the EU-Taxonomy and non-financial reporting due to the revision of the EU Non-Financial Reporting Directive (CSRD). This revision expands reporting obligations to include large, non-public companies (per § 267(3) HGB) as well as publicly traded SMEs.

From January 1, 2025, large non-public companies will be subject to reporting and audit obligations under the CSRD and the EU-Taxonomy Regulation for the calendar year 2025.

WHAT needs to be done?

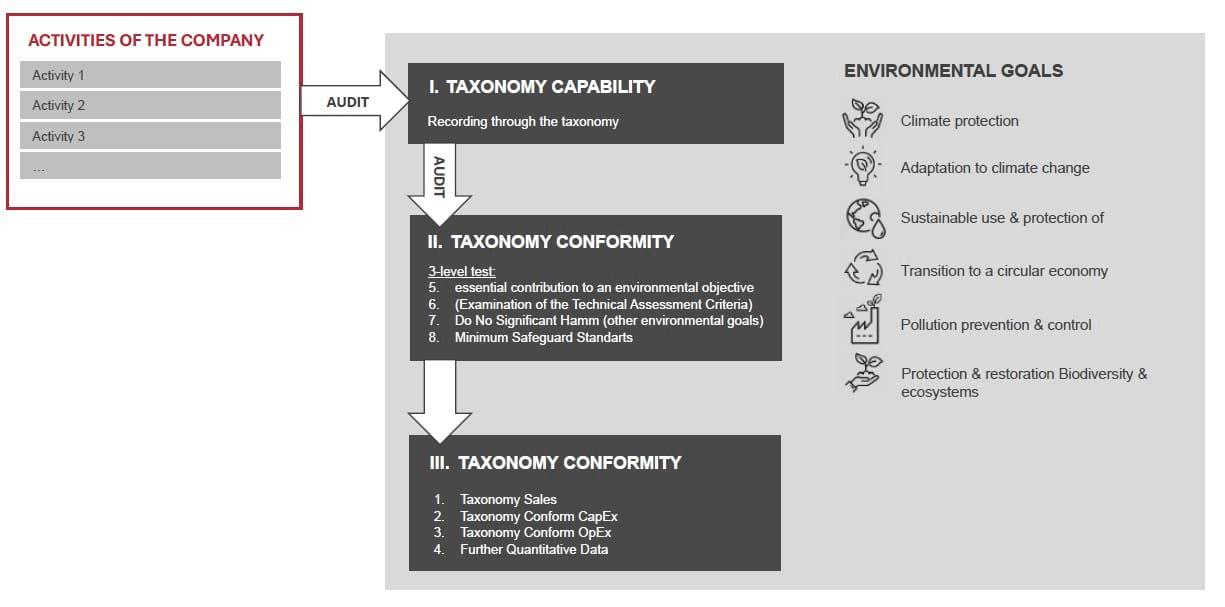

Under Article 8 of the EU-Taxonomy Regulation, companies within its scope must disclose how and to what extent their economic activities, which contribute to revenue, investments, and operating expenses, are environmentally sustainable. This involves assessing all activities for taxonomy eligibility and subsequently for taxonomy alignment based on the six environmental objectives defined by the EU-Taxonomy.

While in fiscal year 2021, only taxonomy eligibility for the environmental goals of climate change mitigation and adaptation was assessed, fiscal year 2022 expanded reporting to include taxonomy alignment for these activities. For fiscal year 2023, eligibility assessments will also include the remaining environmental objectives. From fiscal year 2025 onward, relief provisions will cease, requiring comprehensive eligibility and alignment assessments for all environmental objectives.

In addition to disclosing indicators for revenue, investments, and operating expenses using prescribed reporting templates, companies must also provide qualitative information in their non-financial reports. To comply with these extensive reporting obligations, internal reporting processes should be adjusted early.

Our Range of Services:

- Support in identifying a company’s activities and assessing their taxonomy eligibility and alignment.

- Assistance in determining the required KPIs and qualitative disclosures.

- Preparation of internal documentation regarding the implementation of the EU-Taxonomy Regulation.

- Support in creating the mandatory reports concerning the EU-Taxonomy (non-financial reporting).

- Assistance in adjusting internal reporting processes to meet EU-Taxonomy reporting obligations.